Disclaimer : The post you are about to read is my personal opinion and may not necessarily represent the truth of others. This is my truth and you are free to disagree with me.

3. What is the difference between cutting losses and executing trail stops? How and when do you set these?

In a nutshell, trail stops are there to preserve your gains while cut points are there to protect your capital.

By now, you've probably noticed how I do things in tranches. Because executing your buys and sells in tranches lessens your impact on price swings.

When cutting, I make sure I have two cut points: the first cut point is within the 2-3% range where I lighten up positions, and yes tax and commissions are included in this computation. The 2nd is my maximum cut point of -5% which means that if my position reaches or falls below this level, I cut ALL my positions regardless of the time of day - this rule applies to ALL my trade setups.

When cutting, I make sure I have two cut points: the first cut point is within the 2-3% range where I lighten up positions, and yes tax and commissions are included in this computation. The 2nd is my maximum cut point of -5% which means that if my position reaches or falls below this level, I cut ALL my positions regardless of the time of day - this rule applies to ALL my trade setups.

"Ayaw nyo hintayin yung closing sir? Baka tumaas pa! Why not sell on the bounce?"

What if it doesn't? Always expect the worst case scenario.

"Pwede ba sa 20ma ilagay yung cut point?"

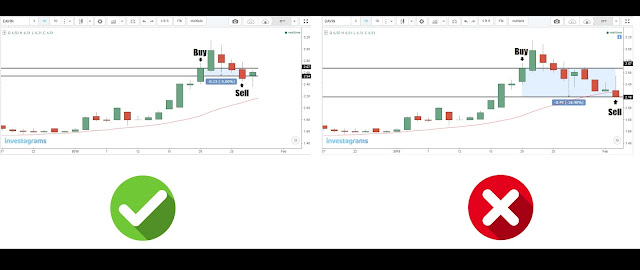

Never confuse a trail stop for a cut loss point. Here's an example of what can possibly happen if you do.

"Pwede ba sa 20ma ilagay yung cut point?"

Never confuse a trail stop for a cut loss point. Here's an example of what can possibly happen if you do.

-5% vs -18%

When my cut levels are hit, I make sure that by the end of the day, I have no positions left. Why? Because whenever you violate your rules, it damages your trading psyche. Imagine if you held on to the loss for the night or drag it on for days and months. You'd have a hard time consoling and convincing yourself if what you did was right. And trust me, this is going to mercilessly torment you.

"Should you have cut? Would it go higher? Maybe if I break my rules just this one time..."

----------------------------------

As for trailing stops, I usually have two sets. One for moving averages and another for Darvas - this is for me to maximize the potentials of both worlds.

Assuming that my average entry price (AEP) is already far away from the current price, only then will I set my MA trail stop. I usually do this when my positions are at least 10% distance from my designated MA stop. For example:

Having an AEP equal to your MA stop is impractical. If you do this, I won't be surprised if you say "Pera na, naging bato pa!"

So here are two alternatives that I frequently use in setting stops. The first is set just several flucs below previous closing price. So if MAC's previous closing was 19.2, then I'll set my stops at 19.1. The second is set on the nearest darvas support. Sometimes, much of your profits get eaten on this stop, but if you're banking on the possibility of a continuation since you're following the trend, you might just get more out of the trade. So carefully weigh your odds.

If you owned this port, what would you do?

In both scenarios of cutting and executing trail stops, whenever I'm loaded with volume and have a hard time selling intraday, I always sell my final tranche during the matching of prices EOD since that's where bulk of the buyers show up. If the last traded price was at 19.2, I'll sagasa sell 10-20 flucs down.

As a final reminder,

----------------------------------------------

Related posts on Cutting and Setting Trails

(Please do post on the comments section the links I've missed)

http://zeefreaks.blogspot.com/2014/11/trading-101-art-of-cutting-losses.html

http://zeefreaks.blogspot.com/2012/10/apm-rise-of-borg.html

"Should you have cut? Would it go higher? Maybe if I break my rules just this one time..."

----------------------------------

As for trailing stops, I usually have two sets. One for moving averages and another for Darvas - this is for me to maximize the potentials of both worlds.

Assuming that my average entry price (AEP) is already far away from the current price, only then will I set my MA trail stop. I usually do this when my positions are at least 10% distance from my designated MA stop. For example:

Having an AEP equal to your MA stop is impractical. If you do this, I won't be surprised if you say "Pera na, naging bato pa!"

So here are two alternatives that I frequently use in setting stops. The first is set just several flucs below previous closing price. So if MAC's previous closing was 19.2, then I'll set my stops at 19.1. The second is set on the nearest darvas support. Sometimes, much of your profits get eaten on this stop, but if you're banking on the possibility of a continuation since you're following the trend, you might just get more out of the trade. So carefully weigh your odds.

If you owned this port, what would you do?

In both scenarios of cutting and executing trail stops, whenever I'm loaded with volume and have a hard time selling intraday, I always sell my final tranche during the matching of prices EOD since that's where bulk of the buyers show up. If the last traded price was at 19.2, I'll sagasa sell 10-20 flucs down.

As a final reminder,

----------------------------------------------

Related posts on Cutting and Setting Trails

(Please do post on the comments section the links I've missed)

http://zeefreaks.blogspot.com/2014/11/trading-101-art-of-cutting-losses.html

http://zeefreaks.blogspot.com/2012/10/apm-rise-of-borg.html