For what is man if he gains the whole world but loses his soul?

Saturday, June 27, 2015

Sunday, June 21, 2015

Friday, June 19, 2015

Bear Traps

Every great candle has a story.

Take the long wick of that green candle for example

that didn't happen abruptly.

Was it planned?

I don't know.

In this story, we have the Bears.

They are Bad-ass MOFOs who are the root of all

the decline in the world - for obvious reasons.

And a great army they are.

They advance and lead the way to more destruction.

Because that's how they are.

But little did they know of what lies beyond.

A worthy adversary. Lying in wait for the perfect

moment the bears let their guard down.

Suddenly out of the mists

they find themselves caught in a trap.

Behold the battlefield is ready.

Enter the Bulls.

Swift, mighty, and just like the bears,

they are many.

They seize the moment and lunge for the enemy.

Without fear they pounce.

For this is their destiny.

(The exact moment the bears knew they were F****ed)

Battled raged the whole day.

But the mighty bulls emerge the victor.

And claim the spoils of war.

But the bears never forget.

Patiently, they wait, as the bulls were.

For the moment they reclaim their honor

and seize their destiny.

The end.

Wednesday, June 17, 2015

Sleeper Plays 101

Sleeper Plays.

Or in a more popular term,

"Bodega Plays"

"Bodega Plays"

Before we start, please click that lovely link below

and observe the stock allocation of the Mage Class

and observe the stock allocation of the Mage Class

During my adventures, I have met some traders who are

in this category big time. I was wondering how some people have

the strength to 'love' just a few stocks for months without rest.

You know, those who post relentlessly on threads of their

favorite stucks, sometimes just talking to themselves

or worse, creating multiple accounts just so these accounts

could talk to each other.

All just so others would take notice - maybe to hype, to

have the thread on the top pages, or some reason who

knows what. It's pretty damn funny sometimes.

in this category big time. I was wondering how some people have

the strength to 'love' just a few stocks for months without rest.

You know, those who post relentlessly on threads of their

favorite stucks, sometimes just talking to themselves

or worse, creating multiple accounts just so these accounts

could talk to each other.

All just so others would take notice - maybe to hype, to

have the thread on the top pages, or some reason who

knows what. It's pretty damn funny sometimes.

I'm sure you guys and gals have met a bunch.

Just a tip in dealing with these types:

Even if we're in the internet,

Never make eye contact.

Never

But the best part about these guys, is when the stock begins a

monster rally. And then they start acting like a know it all guru

and "telling you so." And those who oppose this new guru gets to

be ganged up by the crazy followers - Such magnificent

display of ignorance. But who cares?

monster rally. And then they start acting like a know it all guru

and "telling you so." And those who oppose this new guru gets to

be ganged up by the crazy followers - Such magnificent

display of ignorance. But who cares?

I'm actually guilty on some of these during my ignoramus days.

Moving on....

When dealing with sleepers, you should first ask

yourself these fundamental technical questions:

yourself these fundamental technical questions:

"Has the downtrend come to a stop

and is now on sideways?"

and is now on sideways?"

"Are there signs of bullishness or

higher low (HL) patterns?"

higher low (HL) patterns?"

If you answered yes. The next questions you should

consider if you plan on buying the sleeper are:

consider if you plan on buying the sleeper are:

"Am I willing to wait for at least 3 months?"

"Will I not be tempted if I see other stocks

flying and my sleeper continues to sleep?"

flying and my sleeper continues to sleep?"

If you answer Yes to these, then you're

another step to making that trade.

another step to making that trade.

Because most traders fail to prepare their minds.

And so these things happen:

And so these things happen:

Having the right mindset for the right kind of play and to

the right kind of trader is key to a successful trade.

the right kind of trader is key to a successful trade.

Which means, if you're a trader who loves

quick plays, don't go 'investing'

quick plays, don't go 'investing'

Or if you're buying to invest, don't get excited

every friggin' time your stock goes up.

That's not being multi-dimensional.

That's simply being moronic.

every friggin' time your stock goes up.

That's not being multi-dimensional.

That's simply being moronic.

Search the crevices of your soul and see if

you're a trader or an investor.

you're a trader or an investor.

Now for the last step.

Buying a sleeper means buying at a low range. And buying at

this particular range isn't very easy. For one, it's probably in

an illiquid state. Not a lot of transactions happening.

It can desecrate supports or even give wild upswings

if some trader suddenly loses his mind.

Couldn't get my earlier records. And it doesn't look the

same now because of those stock divs.

So you would have to adjust not just your expected timeframe,

but your exposure and cut points as well - because trust me,

you don't want to be in a "coma" when things go bad.

this particular range isn't very easy. For one, it's probably in

an illiquid state. Not a lot of transactions happening.

It can desecrate supports or even give wild upswings

if some trader suddenly loses his mind.

Couldn't get my earlier records. And it doesn't look the

same now because of those stock divs.

So you would have to adjust not just your expected timeframe,

but your exposure and cut points as well - because trust me,

you don't want to be in a "coma" when things go bad.

But If everything goes well and momentum picks up, volume

and liquidity will gradually improve. And all those days and

stress of hoarding for those shares will finally pay off.

And from here, you get to sweetly decide if you're

going to transition your play to TF or Momentum.

"But Zee, how will I know if it's game time?"

Simple. Once it breaks a major resistance.

Most prolly the 3 or 6 months resitance.

and liquidity will gradually improve. And all those days and

stress of hoarding for those shares will finally pay off.

And from here, you get to sweetly decide if you're

going to transition your play to TF or Momentum.

"But Zee, how will I know if it's game time?"

Simple. Once it breaks a major resistance.

Most prolly the 3 or 6 months resitance.

Keep this simple pyramid in mind.

It doesn't always look like that. But oh well.

You get to say some things when you're ZF.

And as to the upside once momentum kicks in?

Here's an idea:

http://zeefreaks.blogspot.com/2014/11/just-for-records-mrc.html

Here's another one courtesy of a legendary trading buddy:

(Snapshot as of 7.1.2015)

Here's another one courtesy of a legendary trading buddy:

(Snapshot as of 7.1.2015)

And just for this case study:

|

(Thanks in advance sa mga hypers and gurung ulols) |

Just make sure to put the necessary trail stops.

You don't want your gains to be eaten up.

Happy sleep-hunting!

Here's a cat in a painting for no reason.

Update 6.26.2015

(market closing)

So uhh. Yeah. Sleeper Plays.

Problem now is.. Where to sell?

I wish all my problems are like this.

Tuesday, June 16, 2015

The Cost to Trade for a Living

"How Much does it take?"

A few days ago I posted this

That survey, as vague as it might seem, has deeper truth.

Once you have exposed yourself to a certain degree of risk in the

stock market, there would come a time when you would think

I noticed that a lot of people actually consider having a "career"

in trading. To those who answered, thank you for

in trading. To those who answered, thank you for

your time - your entries are duly noted.

So let's talk about this survey shall we?

There were those who answered 50-100k, 3M, and even

a whopping 8 Figures. Nothing wrong with those numbers.

But Yes, to be on the philosophical safe side, the answer

depends on your personal lifestyle.

Example

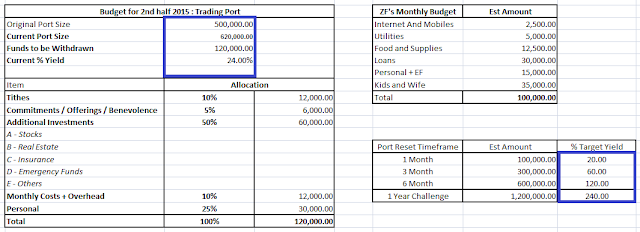

This is how my monthly budget looks. I consume a lot less,

I guess around 16-18k. I'm not much of a spender, I stay home

most of the time, and since I'm province based, living expenses

are cheap compared to the big cities.

And just for sample's sake, here's my "made up" projected budget

when my port gets reset by the end of this month.

|

(As of 6.12.2015)I call this, "The Table of Needs" |

For those of you who just tuned in to my blog, Every 3 or 6

months, I press the reset button on my trading port and it

goes back to its original port size which is 2M.

The profits go to the projected budget above.

If no profits have been made, no withdrawals will be done and poor

ZF will have to live on cup noodles and the emergency fund until

the trading port yields gains and improves on the next reset.

On the table above and with my port size, I just need to make a

clean +1.25% or 25k in order to survive for a month. And

+1.25% is something I can achieve with ease and no pressure.

I'm currently on the 6-month port reset mode and already got my

2nd half 'needs' covered - anything excess of that +7.5% is the area that I consider

"enjoying my stock profits"

But what if my port size was smaller?

A lot answered 100k Capital. So let's see how that goes

and how it will affect my current Budget.

To maintain my monthly "lifestyle" I'll have to at least make

25% A MONTH! Now That's crazy and full of pressure.

You'll have to be a guru who always goes All In on basuras and can

consistently see the future to be able to live with 100k Capital.

Di pa kasama yung "enjoying profits" area jan and some existing commitments

I have won't be supported or would be "short sa budget."

So how about those who say, 500k Capital is the way to go?

In this example, let's assume I'm a family man living in the big city,

got kids and a wife to support and I'll need to get 100k of profits

(+20k bonus) every month to sustain my family.

20% A month. And that 4% only gave a small boost.

Still a High number, budget screwed and is

definitely NOT Sustainable.

If you're single and have a smaller budget,

it might be acceptable.

I can imagine the look on people's faces when they've

reached their target and got wiped out in a single trade

because of the pressure to have "more"

----------------------------------------------

After discussing with my students on the subject, majority agreed

that 5% is the "minimum" target one should gain in a month on his

or her overall port that isn't too stressful to maintain as long as a

system is in place and assuming trading consistency is achieved.

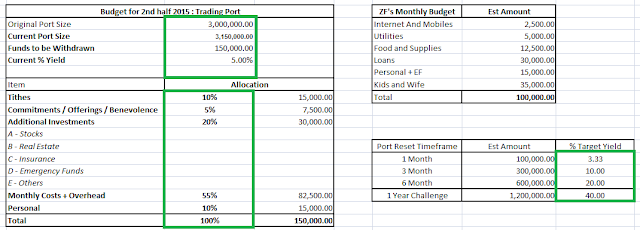

Now let's try ZF the Family Man with 3M Capital,

Living in the big city, with wife and kids and

a more balanced Budget.

A +3.33% monthly target ain't that hard right?

And that extra +1.67% or 50k pretty much gets you

somewhere fancy for some R&R.

These tables are just projections. If you seriously consider trading

for a living. You better be prepared and consider all angles.

Here's a link to that spreadsheet If you wish to do

some tweaking of your own:

Click here

Here's a link to that spreadsheet If you wish to do

some tweaking of your own:

Click here

And If you haven't reached your ideal Port Size yet,

then dream big and work hard for it.

Because one day, hopefully,

You will.

I did.

Tuesday, June 2, 2015

Random Log 6.2.2015 - B

As I was searching for people to follow in the

markets, I particularly liked one person in the FM Forum.

COM - Colorofmoney

I was awed by the guy's work and performance.

And it was a mystery to me as to why why a whale would

hang out with the sharks, fishes and shrimps.

I never got the chance to talk to him.

I remembered blurting out at some point

that I wanted to be like him.

I never got the chance to talk to him.

I remembered blurting out at some point

that I wanted to be like him.

If you ask where I got my inspiration to start a blog and make

outrageous posts, COM and his blog was the reason.

Check it out.

Kind of made me sad when he stopped updating his blog.

Who else misses this guy?

Random Log 6.2.2015 - A

A few days ago a friend asked me

"When was the first time you got exposed to stocks?"

And after some time. It got me thinking.

Then my mind was blown as I remembered I was "playing" stocks

as early as 2001 along when I created my first email address

that sounded extremely corny.

Maybe that's one reason why I see the markets as a Game.

Foreshadowing just got real.

Subscribe to:

Posts (Atom)